TL;DR Summary

- The Problem: Mainstream processors are “scared” of MCC 7322 not because your business is bad, but because they fear high chargeback ratios, jeopardizing their crucial sponsor bank relationships, and reputational risk.

- Their Solution: They take the easy way out by imposing debit-only restrictions. This protects them but severely limits your agency’s revenue and efficiency.

- The Expert Solution: A specialized processor like Payscout doesn’t avoid risk; they manage it with advanced tools, proactive chargeback prevention, and strong banking relationships built for specific industries. Partnering with a certified MBE further ensures you’re working with a reputable, high-caliber provider.

- The Takeaway: Don’t settle for a partner that isn’t equipped to serve you. Choose an expert that has the capability and knowledge to help your agency succeed with a full suite of payment options.

If you run a collection agency, you’ve likely felt the frustration. You operate a legitimate, compliant business, yet when you apply for a merchant account to accept credit cards, you’re either rejected or forced into a restrictive “debit-only” plan. It can feel like you’re being unfairly penalized.

The truth is, from the perspective of a standard, low-risk payment processor, your business is viewed through a lens of extreme caution. They aren’t scared of your specific agency; they are wary of the category you’re in: MCC 7322.

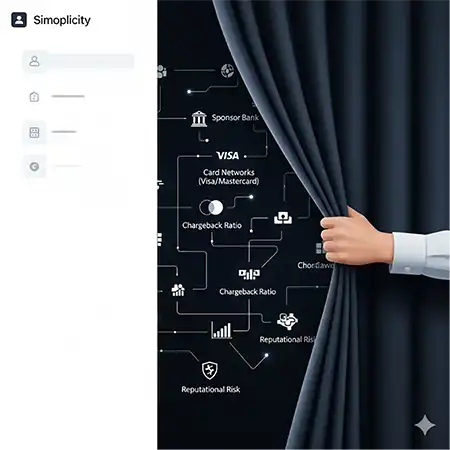

To understand how to find the right partner, it’s crucial to look behind the curtain and see the specific risks a generic processor is trying to avoid—and how a specialized provider is uniquely equipped to manage them.

The Anatomy of “High-Risk” for a Payment Processor

When a processor’s underwriting team sees MCC 7322, several alarms go off. These concerns are rooted in the financial mechanics and relationships that govern the entire payments ecosystem.

- The Chargeback Ratio Threat

A chargeback is a transaction reversal initiated by a cardholder’s bank. While they exist to protect consumers, they can be a major problem in the collections industry. Payments can be disputed for various reasons—the consumer doesn’t recognize the charge, feels pressured, or simply has “buyer’s remorse.”

Processors are monitored by card networks like Visa and Mastercard. If a processor’s portfolio of clients exceeds a certain chargeback-to-transaction ratio (often as low as 1%), they face steep fines and, in severe cases, can lose their ability to process payments entirely. For a generic processor, a handful of MCC 7322 clients can threaten the stability of their entire low-risk portfolio.

- The Sponsor Bank Relationship

Processors don’t connect to Visa and Mastercard directly. They need a partnership with a “sponsor bank” that is a member of the card networks. These banks are typically very conservative. If a processor brings on too many high-risk clients who generate chargebacks and complaints, the sponsor bank may view them as a liability and terminate the relationship. Losing a sponsor bank is a catastrophic event for a processor.

Therefore, a mainstream processor will almost always choose to protect their banking relationship by simply declining or restricting industries they don’t fully understand.

- Reputational Risk

Standard processors and their sponsor banks cater to a wide audience of “safe” businesses like retail stores and restaurants. They see the collection industry, fairly or not, as having a higher potential for negative press and regulatory scrutiny from bodies like the CFPB and state Attorneys General. Avoiding the industry altogether is seen as the easiest way to protect their brand.

The Easy Way Out vs. The Expert Approach

Faced with these risks, a generic processor has two options.

The Easy Way Out: The simplest, most blunt instrument is to impose a debit-only restriction. This eliminates the primary source of chargebacks (credit card disputes), protecting the processor and their sponsor bank. It’s a solution that prioritizes their safety over your agency’s revenue and operational efficiency.

The Expert Approach: A specialized high-risk processor operates differently. Instead of avoiding risk, they manage it with precision and expertise. This is how a partner like Payscout can confidently support MCC 7322 clients with a full suite of payment options. The strategy includes:

- Specialized Underwriting: We don’t just see a merchant category code; we look at your specific business. We analyze your compliance record, collection practices, and history to build a complete risk profile.

- Proactive Chargeback Management: We use sophisticated tools that provide early-warning alerts for potential disputes. This allows many issues to be resolved and refunded before they become a formal chargeback, keeping your ratio clean.

- Intelligent Fraud Prevention: Our systems use advanced technology to monitor for suspicious transaction patterns, protecting your agency from fraudulent activity that could lead to disputes.

- Established High-Risk Banking Relationships: We have cultivated strong, long-term relationships with sponsor banks that understand and are comfortable with the collections industry. They trust our ability to manage the risk effectively.

Choosing a partner committed to ethical and expert practices is paramount. Payscout’s status as a certified Minority Business Enterprise (MBE) reflects this commitment, demonstrating a dedication to a higher standard of partnership that goes beyond just the transaction.

Conclusion: The Problem Isn’t You, It’s Their Capability

The difficulty in securing a full-featured merchant account for MCC 7322 doesn’t mean you’re running a bad business. It means you’re talking to the wrong kind of processor.

A mainstream processor sees your industry as a liability they are not equipped to handle. A specialist sees your industry as their area of expertise. By understanding the risks and investing in the tools, relationships, and knowledge to manage them, a true partner can offer the payment flexibility you need to thrive—safely and profitably.